Admiral Markets

Pros

- High leverage levels provided

- Strong regulation and many years of experience

- Transparent pricing

Cons

- Not enough pairs to trade

- Profits withdrawal can only happen through bank transfer

- Does not accept U.S. Clients

Min Deposit

200Max Leverage

1:400Mini Account

Bonus

50Platforms

Withdrawal Options

- Bank Wire

- Credit Cards

- Neteller, PayPal, Skrill

Review

Introduction

Admiral Markets was launched in Estonia back in 2001 and has since stretched out its geographic reach to become a notable global online Forex broker. The broker is dedicated to offering a wide range of trading products to traders from all corners of the world.

Thanks to Admiral Markets, traders have an opportunity to trade in CFDs in shares, Forex, cryptocurrencies, Bonds, Market Indices, and commodities. In total, the broker provides up to 106 CFDs and 55 currency pairs.

For transparency purposes, the broker is licensed and regulated in the European Union (EU) by the Estonian Financial Supervision Authority and in the United Kingdom by the Financial Conduct Authority (FCA).

In the United Kingdom (UK), the company’s brokerage activities are authorized by the Financial Conduct Authority (FCA) while the Cyprus Securities and Exchange Commission (CySEC) authorizes and regulates the broker’s activities in Cyprus.

In 2015, the broker won the Best MT4 broker award during the United Kingdom Forex Awards. The same year, the New Europe magazine listed the broker among the “Best of the Best”. Still, in 2015, Admiral Markets took part in Poland's FX Cuffs Forex conference and was branded "Best Foreign Broker."

- Products and services are offered in multiple languages

- The website is easy to use

- Multiple best broker awards winner.

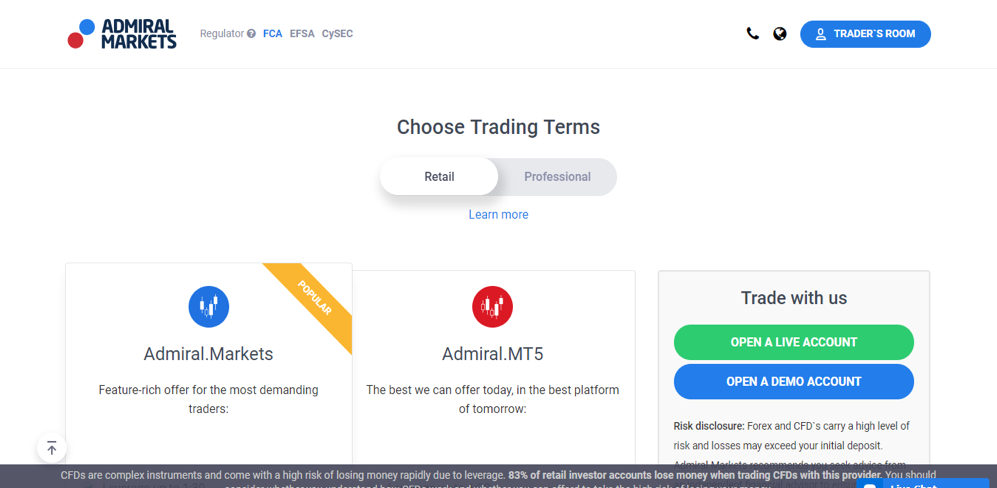

Trading Conditions

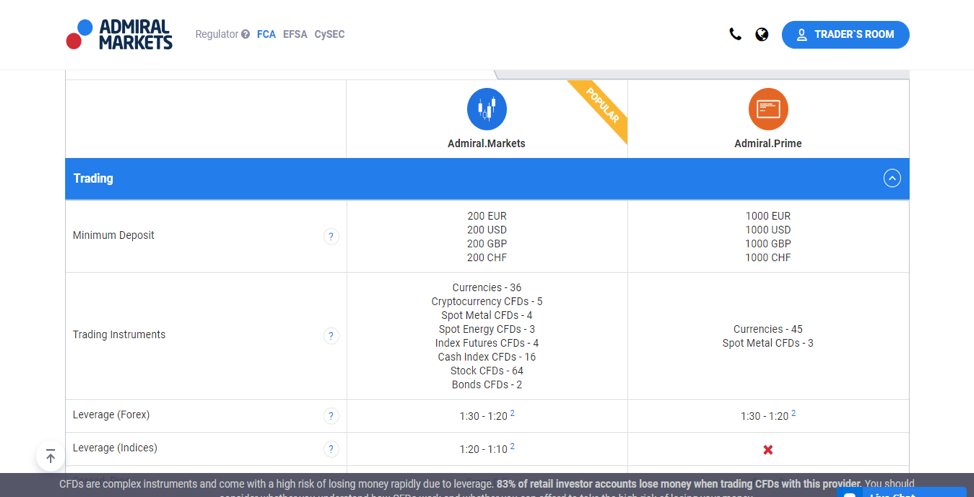

This online Forex broker offers 3 different types of account. The most popular is the Admiral Classic account, and to open it traders must deposit a minimum of $200.

The other two accounts are the Admiral MT5 and Admiral Prime. Before traders can start trading with these two, they must deposit a minimum of $1,000 in their accounts. Admiral Markets’ accounts have varied asset list with different leverages for traders to choose from. Both the Admiral Prime and Classic accounts utilize the MetaTrader 4 platform. However, the Admiral MT5 account, as the name suggests, utilizes the MT5 trading platform.

The broker offers bonuses, variable spreads, and leverage of about 1:400. An average of EUR/USD 1.2 and 0.6 pips is offered on the commission-free and ECN accounts respectively. This implies that trading costs on the various types of Admiral Markets’ accounts are almost similar.

A trader is given a deposit bonus of 30% each time they deposit cash in to their account. Most recently, the company launched a promotion dubbed ForexBall competition where traders stand a chance to win up to $541,000. The purpose of the promotion is to educate participants on how they can monitor their successes.

- The company offers bonuses and promotions to traders

- The execution speed is remarkable

- The accounts offered by Admiral Markets are perfect for both newbie and experienced traders

Products

Traders prefer trading with Admiral Markets because of the broad range of products it offers. Some of these products include Indices, Stocks, Spot Energies, and Spot Metals. Admiral Markets also offers up to 55 currency pairs and a total of 106 CFDs.

- Broad range of products

Regulation

The Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), the Estonian Financial Supervision Authority, and the Australian Securities and Investment Commission (ASIC) are some of the bodies tasked with regulating the brokerage activities of Admiral Markets in the UK, Cyprus, Estonia, and Australia respectively.

- Authorized in the EU

- FCA regulated in the UK

- ASIC authorized in Australia

- Regulated in Emerging Hub

- CySEC regulated in Cyprus

Platforms

The broker supports both MetaTrader 4 and MetaTrader 5 platforms. The MT4 platform is available in web version, mobile, and as desktop.

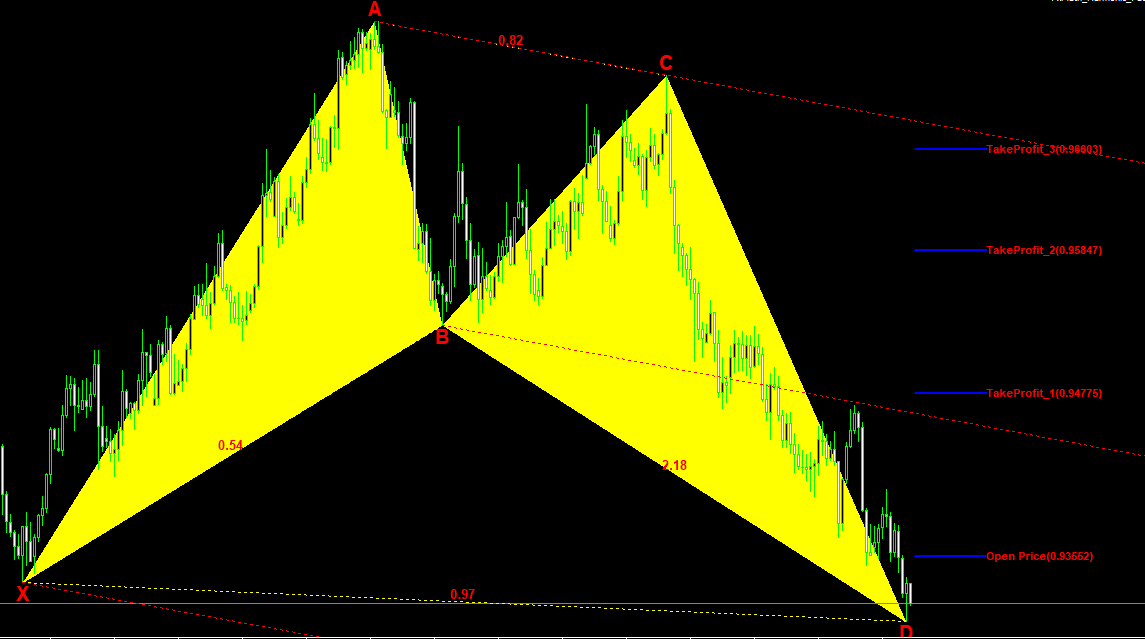

The MetaTrader 4 platform offers all the necessary resources required by traders such as various technical indicators, Expert Advisers, back-testing, single-click trading capability, and advanced charting package.

Additionally, the broker has developed a powerful MetaTrader 4 plug-in by the name of MT4 Supreme Edition. The MT4 plug-in contains some performance-enhancing tools that include: Trading Terminal, Correlation Trader, The Mini Trader, Correlation Matrix, and Alarm Manager. The broker also supports the MetaTrader 5 platform where both mobile and desktop versions are available.

- MetaTrader 4

- MetaTrader 5

- Desktop platform for Mac and Windows

- Demo virtual trading

- Web platform

Mobile Trading

Admiral Markets also supports mobile trading. With mobile trading, traders can conveniently trade from anywhere in world provided they have internet connection. MetaTrader 4 and MetaTrader 5 mobile apps are compatible with both Android and iOS mobile devices and can be downloaded from Google Play and Apple Store respectively. Unlike the desktop version, which contains extra add-ons for experience enhancement, mobile applications come standardized on iOS and Android.

- Android app

- Apple iOS app

- Trading-Forex

- Trading- CFDs

Pricing

Traders are required to deposit a minimum of $1,000 dollars in their Admiral Prime and Admiral MT5 accounts before they can trade. Additionally, all Admiral Markets’ accounts have a minimum order size of 0.01. Importantly, the broker allows hedging on both Admiral Prime and Classic accounts.

Newbie traders can open Classic, Admiral Prime, and Admiral MT5 demo accounts to practice how to trade. This implies that traders looking to experiment with Forex can apply for a free Admiral Markets demo account. With every free demo account, the broker offers free $10,000 virtual funds to help traders get started.

- Competitive pricing

- Average spread EUR/USD 1.2

Deposits & Withdrawals

Traders can deposit funds into their Admiral Markets accounts using popular payment systems including bank wires, Neteller, Skrill, credit cards, and others. However, traders can only withdraw their funds through bank transfers. Most of the time, commission charged differs from country to country.

- Offers a wide range of payment methods

- Traders earn bonuses whenever they deposit

- Deposit are processed almost instantly

- No minimum withdrawals

Customer Support

The broker offers customer support through live chat and phone. Traders can get technical assistance at any time of the day or night. In Europe and Australia, the company offers live chat and phone support in more than ten different languages.

Additionally, the broker offers remote customer support to traders. For instance, if a trader has some software questions or technical issues related to the MT4 platform, the broker can quickly offer assistance remotely.

- Round the clock customer support

- The live chat is easy to access

- Knowledgeable support staff

- Services are offered in dozens of different languages

Research & Education

The broker offers a broad range of research tools. It is safe to say that Admiral Markets is one of the few brokers who go out of their way to deliver competitive research tools to traders. Traders can easily switch between market research tools and different content sections.

Admiral Markets also offers webinars, books, and seminars. Traders are free to choose their desired format. In addition, the broker provides informative articles and trading examples. Webinars are offered almost every day. Brochures are offered in multiple languages and distributed globally.

- Daily market commentary

- Trader webinars

- Trading videos for beginners

- Economic calendar

Noteworthy Points

Admiral Markets is dedicated to providing only the best services to traders. That’s why it provides answers to FAQs on its website. The company posts Wave, technical, and fundamental analyses on a daily basis. In addition, it clearly displays an economic calendar as well as Central Bank rates on its website.

- Offers education and research

- Trade ideas

- Economic news sentiment

- Forecasts

Conclusion

Admiral Markets is a trustworthy Forex broker with many years of experience. The broker offers a handful of products for new and advanced traders. Its website is easy to use and guarantees a wonderful trading experience. The bonuses and promotions offered by the company encourage new traders to open accounts.

Comparison

Broker Comparison Maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

User Reviews

3

Based on 1 ratings

Login to leave a review

Log in