Capital.com

Pros

- Strong technology focused educational resource

- Regulated by the FCA in the UK and CySEC in Cyprus. Operates across the EEA via the Mifid

- financial passporting system

- Wide range of tradable markets

Cons

- MT4 trading platform not offered

- Still a new broker so lacks history

- U.S.-based traders cannot open an account with Capital.com

Min Deposit

$100Max Leverage

1:30Mini Account

Bonus

N/APlatforms

- In-house Product

Withdrawal Options

- Debit or Credit card

- Wire Transfer

- Major E-Payment providers

Review

Introduction

A relatively new arrival to the market, Capital.com was established in 2016, simultaneously opening offices in London, Cyprus, Gibraltar and a development office in Minsk, Belarus, where the company’s technology team is headquartered. Despite being a young company, there appears to be significant investment ($25 million was invested in the company by VP Capital and Larnabel Ventures in 2017) behind the broker and it has quickly succeeded in attracting large numbers of traders, with the company itself claiming over 300,000 accounts, which, depending upon whether that figure refers to active or opened accounts, would propel it above some of the biggest online trading platforms in the world. A major advertising campaign that includes sponsorship of Spain’s Valencia football club has succeeding in quickly raising the broker’s profile.

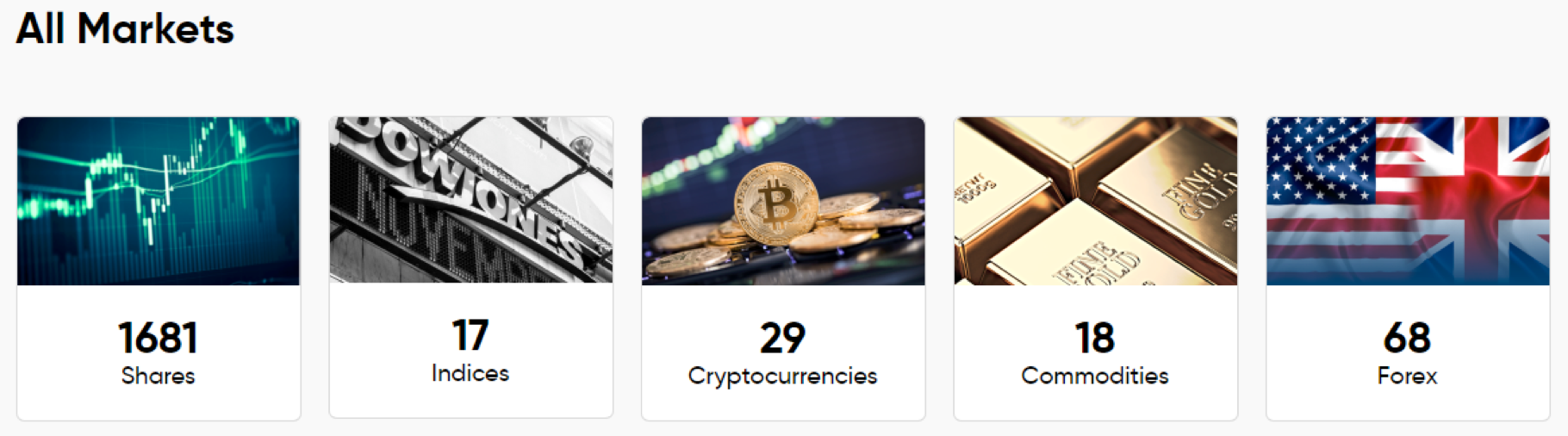

Describing itself as a ‘fintech’ company, Capital.com places an emphasis on its technology and has incorporated AI into its education app and trading platforms. A wide range of over 2000 financial instruments are available to trade across forex pairs, cryptocurrencies, commodities, indices and individual equities.

Capital.com has won several prestigious rewards over the course of its relatively short history. These include:

- Most Innovative Broker 2018, the European Forex Awards

- Best Forex Trading App 2018, UK Forex Awards

- Most Transparent Brokerage Service Provider 2018, the European Forex Awards

- Best Trading Platform 2017, Forex Awards

Trading Conditions

Capital.com has quickly gained a solid reputation as a strong, reliable broker offering good trading conditions and levels of customer service. Technology is certainly a key strength, unless you are a dyed-in-wool MT4 trader, with Capital.com preferring to only offer its own in-house technology and trading platforms. As might be expected from a broker that has built its trader-facing and back-office technology from the ground up within the past couple of years, speed of order fulfilment is to a very high level and slippage minimal, in part helped by the fact that Capital.com operates a market maker model.

Capital.com offers leverage threshold in line with new ESMA limits. Maximum leverage available is 1:30 for the most liquid forex pairs, 1:20 for non-majors, liquid commodities such as gold and oil and major indices, 1:5 for individual stocks and 1:2 for volatile cryptocurrencies.

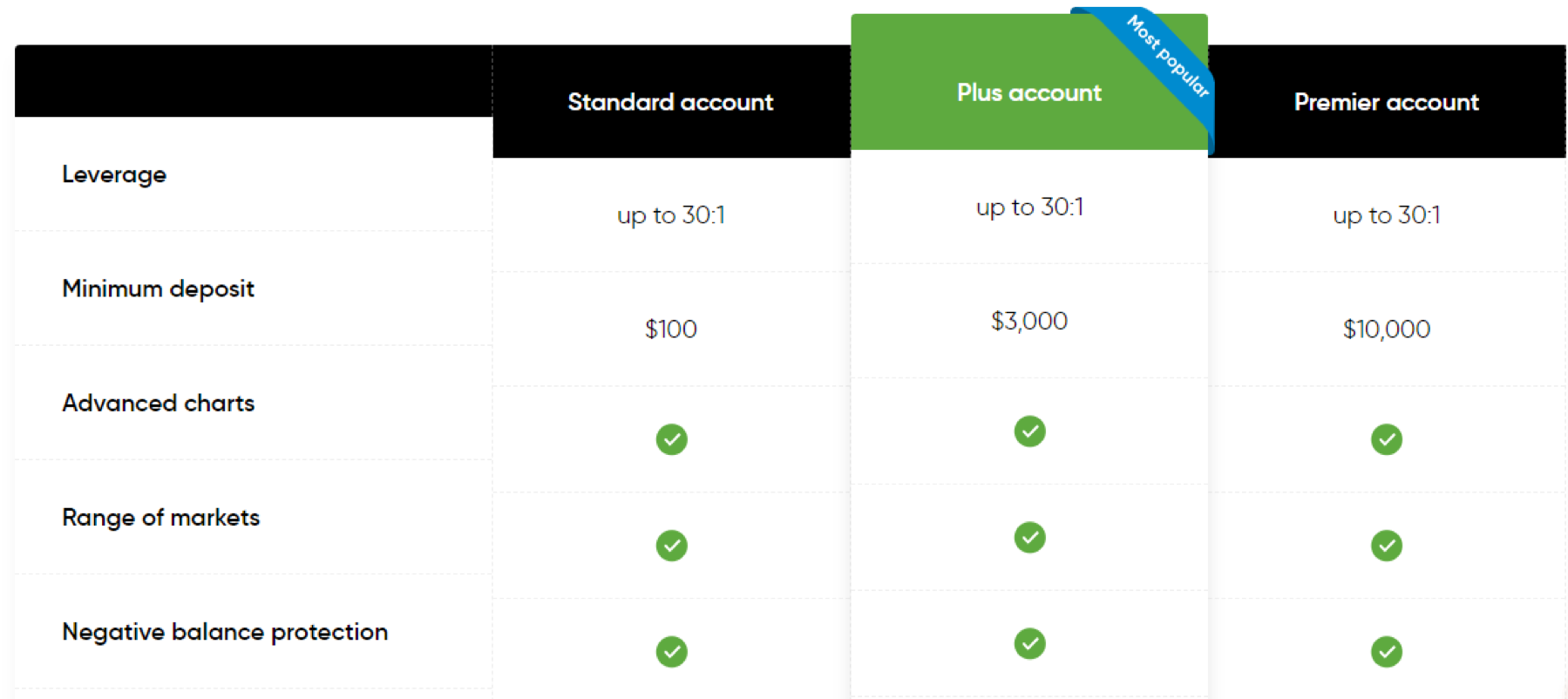

Three kinds of account are offered by Capital.com, with the Standard account most suited to beginners and inexperienced traders, the Plus account targeted at intermediate traders and Premier account the more experienced. The minimum deposit is just $100 or the equivalent in other base currencies supported such as euro, pound and zloty, though the minimum deposit does rise to $250 if made by wire transfer rather than card.

Products

Capital.com provides traders on it platform with an impressive range of tradable markets. There are 1800 tradable financial instruments in total across forex pairs (68), commodities (18), cryptocurrencies (29) indices (17) and the selection of individual equities is particularly rich with a total of 1,681 available. IPOs and ETFs are not available to trade as of yet but the selection covers every imaginable regularly traded instrument and a great deal more on top of that.

Regulation

Capital.com is regulated by both the FCA and CySEC. The two respective regulated companies are Capital Com (UK) Limited and Capital Com SV. The former’s company registration number is 10506220 and FCA registration no.793714. The latter’s company no. is HE 354252 and CySEC license number 319/17.

Platforms

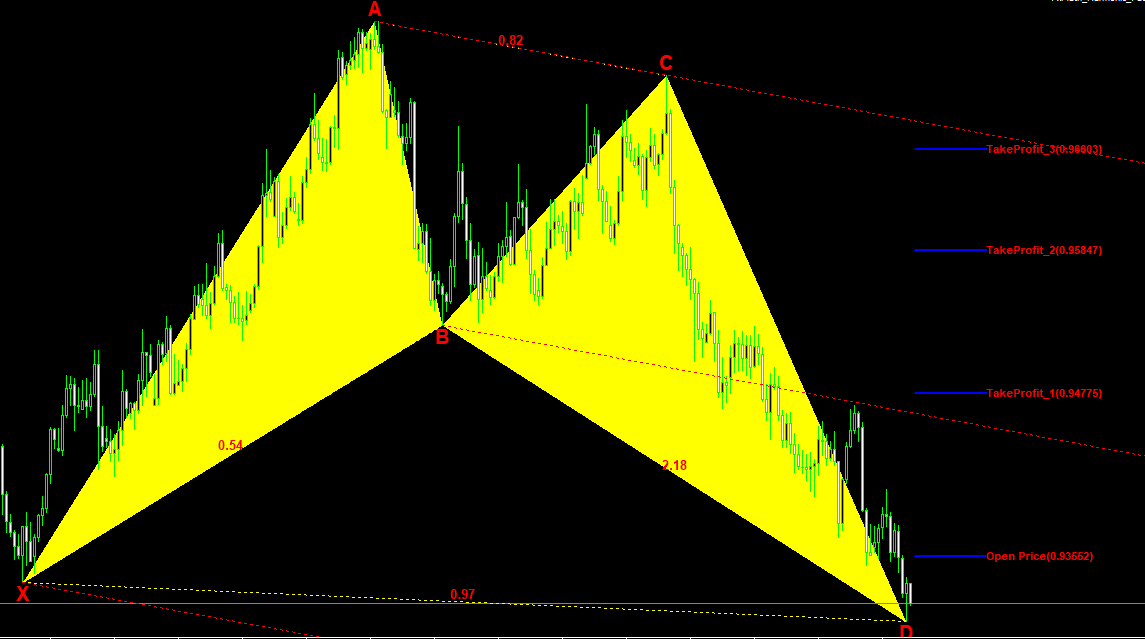

Capital.com offers one core trading platform, the company’s own in-house product, in both desktop and native mobile app formats. The broker really emphasises its own proprietary in-house tech but does its ‘Web Platform’ stand up to or even outperform the industry standard of MT4, which is not offered? It’s undoubtedly a high quality trading experience but if it is actually better than MT4 will really come down to a personal preference. For beginners, the Web Platform is more intuitive, with a recent update further improving usability. Data is presented very nicely with the ‘Trade Hub’ setting using AI to tailor information presented to particular traders based on their historical trading patterns. The ‘Discover’ functionality adds further depth here and includes information such as news and highlights any recent changes in the markets the trader most often takes positions in.

The multi-chart option, which allows for several charts on the screen at one time, and drawing tool, which is part of the charting package, have been particularly well crafted.

Mobile Trading

Capital.com takes great pride in its mobile apps, native Android and iOS versions are both available, and not without reason. The apps offer an impressively slick on-the-go compliment to the web-based desktop trading platform. The majority of functionalities translate to the smaller screen in a way that means trading via one of the apps is almost as convenient as doing so on the desktop format. News and market information is conveniently separated out from the charts to prevent overcrowding and the only major functionality that has had to be excluded from the apps is the multi-chart format that necessitates a larger screen.

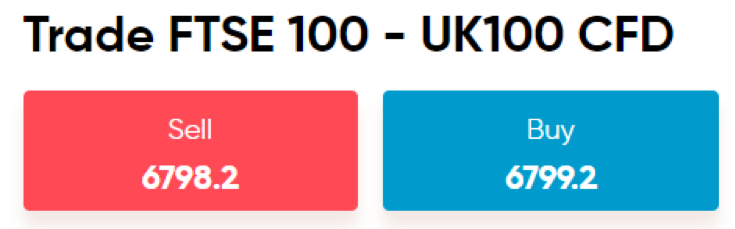

Pricing

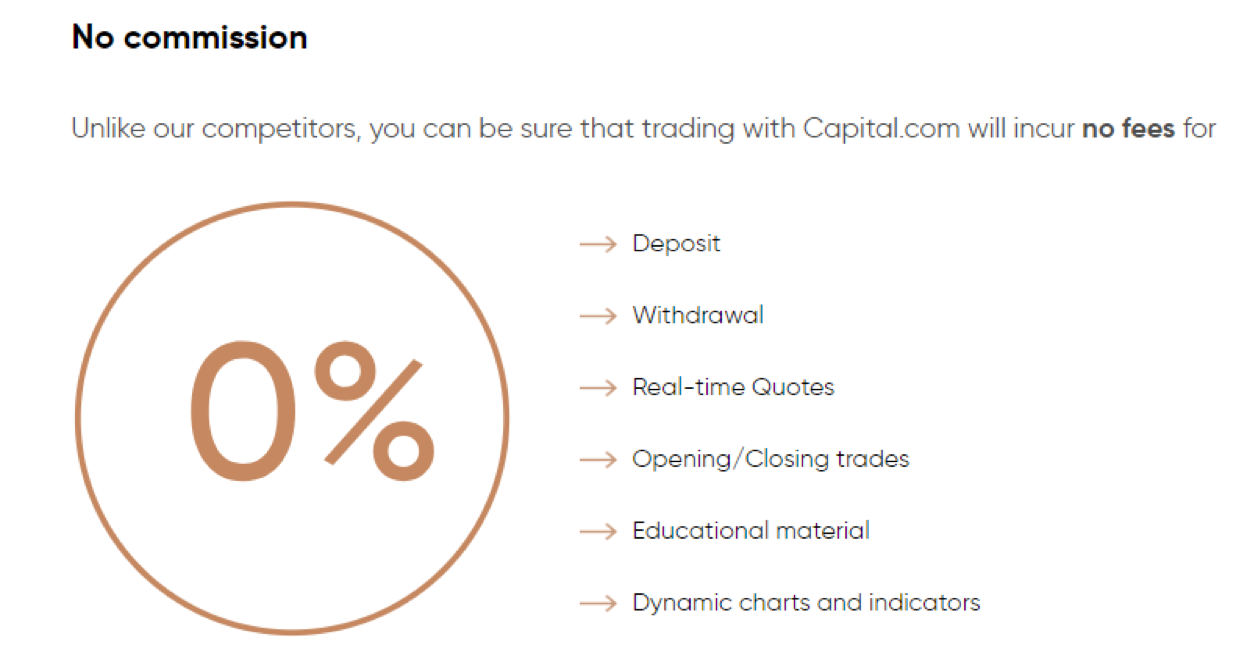

Capital.com has a very attractive pricing and charges structure, which in the modern competitive environment for online brokers is practically a must for any company that, like Capital, has ambitions to take a significant market share. There are almost no fees applied outside of Capital.com’s spread-based business model.

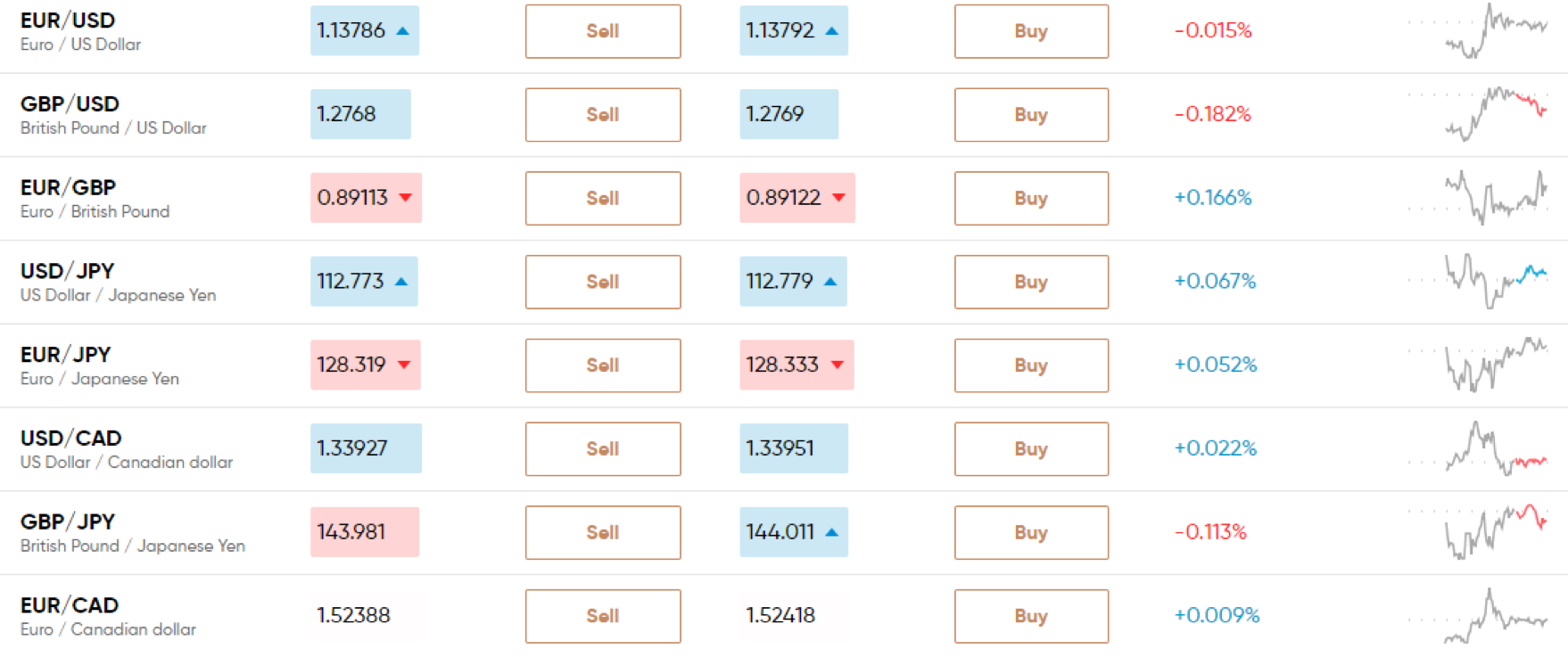

One negative is the fact that Capital.com does not publish data on average spreads, which are floating, over a relevant period of time. Looking at the live sell and buy prices most commonly traded instruments suggests spreads are tight, around 0.6 pips for EUR/USD. However, until the broker transparently publishes average spreads for instruments question marks will inevitably remain.

Deposits & Withdrawals

Deposit and withdrawal options are a strength of Capital.com, with no charges applied and a conveniently broad range of payment methods accepted. The options supported are:

Debit card, credit card, Bank Wire Transfer, Sofort, iDeal, Giropay, Multibanko, Przelewy24, QIWI, Webmoney, Trustly, Neteller and Skrill.

The minimum deposit to fund an account is $100 or equivalent in other major currencies eg. £100 in the UK or 400 zloty in Poland and no minimum or maximum withdrawal level is mentioned on the Capital.com website or in terms and conditions.

Capital.com states that all withdrawal requests are processed within 24 hours though that does not include additional processing time that may be needed by the payments system preferred by the trader. There is no evidence of any significant withdrawal problems being reported by traders using the broker.

Customer Support

Capital.com provides customer support via online chat, email (with a commitment to respond within 24 hours) and popular messengers such as Facebook Messenger, Skype and Whatsapp. Telephone numbers for all four of Capital.com’s offices and local numbers for each territory the company operates in are also published on the ‘contact us’ section of the website. Live customer support is available 16 hours a day, 7 days a week. With many brokers only offering Monday to Friday support, providing support options over the non-market weekend hours can be considered a plus.

Research & Education

Education is a particularly strong suite of Capital.com and significant effort and investment has been put into this area. The broker has developed a stand-alone app ‘Investmate’, which is dedicated to the education of new and less experienced traders. Written content, videos, tips, trends and a useful quiz format to review and reinforce learning are all incorporated into the app in a very user friendly fashion. The interactive tests to test how much a trader has taken in from the educational materials is an especially useful addition.

As well as the Investmate app, the AI-powered news, research and data provided through the Web Traders platform and trading apps can be considered Capital.com’s USP. Common trading biases are pointed out, which can be very helpful in pointing out to traders that their actions are becoming potentially irrational at key moments.

Noteworthy Points

Capital.com can be considered a front runner in terms of incorporating contemporary AI algorithms into a personalised trading platform experience. Prioritising news, education, hints&tips and trading style and observed biases based on each trader’s individual on-platform behaviour and incorporating it into the information and data presented to them is a USP.

Sponsorship of Valencia Football Club has helped Capital.com to quickly raise its profile and establish a well-known trading brand despite only having been established in 2016.

Conclusion

Capital.com is a very slick looking broker with an impressive set of proprietary tech powering its trading platform and value added tools, apps and functionalities. High profile sponsorship of Spain’s Valencia Football Club and an extensive marketing campaign has seen it gain a significant market foothold in just over 2 years and it is doing many things right, particularly around making deposits and withdrawals painless. This broker will likely appeal most to beginner and less experienced traders, which do appear to be its main target market and the lack of MT4 may not appeal to traders already used to the industry standard trading platform. Not publishing transparent average spreads is also a criticism that Capital.com would do well to respond to if it wishes to move forward as one of the best and most popular trading platform providers and brokers on the market.

Comparison

Broker Comparison Maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

User Reviews

4.3

Based on 2 ratings

Login to leave a review

Log in