EverFX

Pros

- Great pricing structure

- Range of investment options

- Quality educational offering

Cons

- Non-existent research section

- Some issues with making withdrawals

- Conservative investment offering

Min Deposit

£250Max Leverage

1:500Mini Account

Bonus

N/APlatforms

- STATUS

- MT4

Withdrawal Options

- Wire Transfer

- Credit Cards

- Debit Cards

- Certain E-Wallets

Review

Introduction

EverFX is a broker that operates under the name ICC Intercertus Capital Limited. They have their operations licensed and regulated through the Cyprus Securities and Exchange Commission (CySEC).

They also have the relevant permission to be able to offer some of their investments to those in the United Kingdom. They have properly been in business since 2017 and they started their operations in Cyprus. They cater for many different languages and their platform is very straightforward to earn and to get started trading.

Trading Conditions

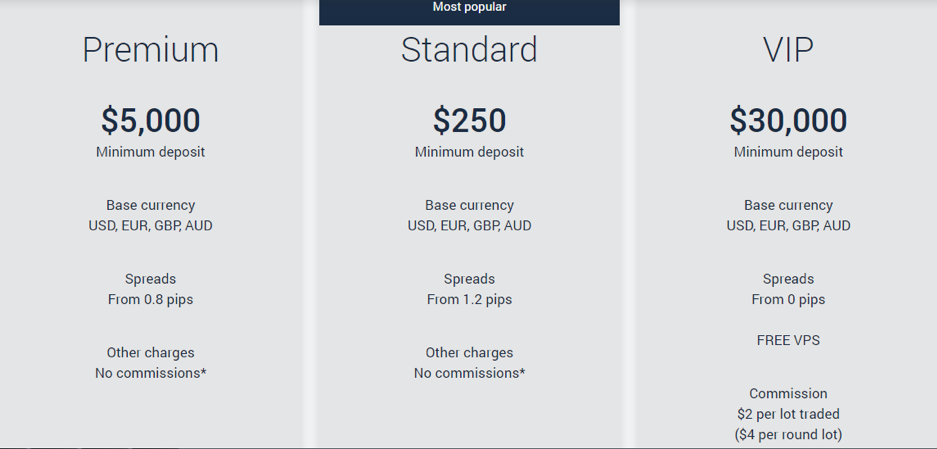

There are different types of accounts for you to choose from at EverFX depending on your specific needs. They are a pure STP broker and every account is going to have tight variable spreads.

The level of leverage and commission will change depending on the account type. For the most part, the largest leverage that a user will be able to get will be 500:1. They also have swap free Islamic account that is compliant with Sharia law.

Products

EverFX is still relatively new in their life span as a broker. Therefore, their offering is still a bit lacking. They have somewhat of a conservative or traditional offering. EverFX is lacking the likes of crypto CFDs which are popular with many other modern brokers.

They do have more than 50 currency pairs for you to trade, as well as numerous spot metals and energies products. They also have a wide variety of both European and American shares for you to trade.

Regulation

EverFX is regulated by the respectable Cyprus Securities and Exchange Commission. They also adhere to a lot of the rules laid out by the Cyprus Investment Firms policy. This includes having at least €730,000 in reserve to confirm that they remain financially stable.

They also keep the funds of their customers in accounts that are segregated from the operating funds of the business. This means that in the case of insolvency, customer funds cannot be touched.

They are also part of the Investor Compensation Fund, which sees people get as much as €20,000 if EverFX goes into default. Finally, they are MiFID compliant and have cross border services throughout Europe.

Platforms

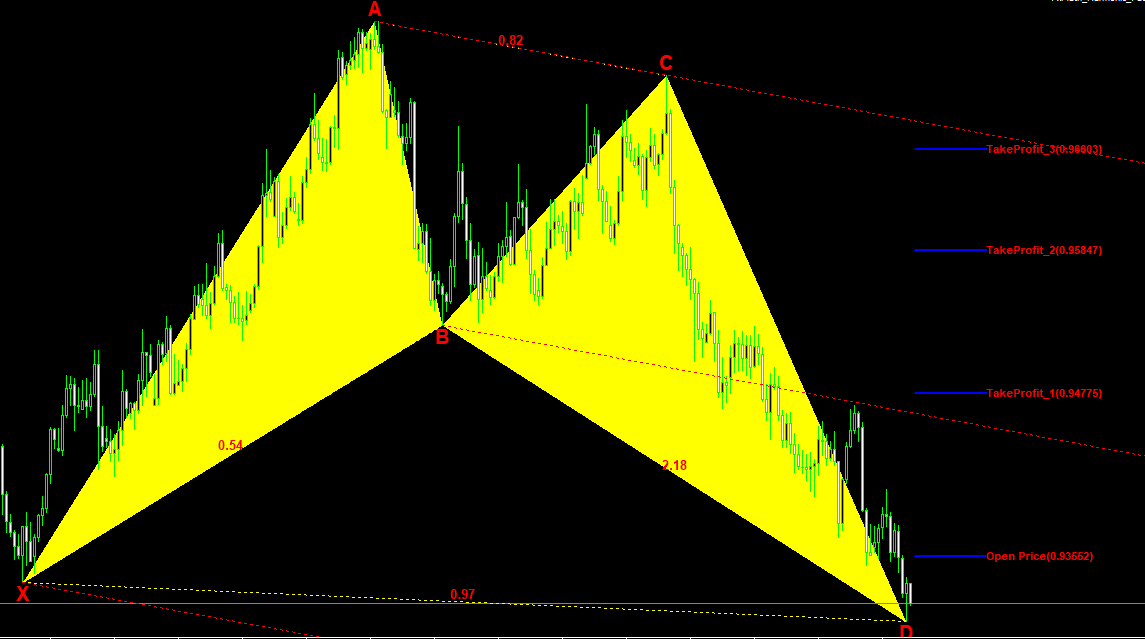

There are two different trading platforms you can choose from at EverFX. They have the industry standard MetaTrader 4 that is familiar to most people who have used online brokers before. There is also their proprietary software known as STATUS. MetaTrader 4’s strengths lay in their charting options, as well as working extremely well across a variety of different devices.

Status is preferred by those who like social trading. You can easily see the performance levels of other traders on the platform. You can cop their trades if you want to or you can simply use it as a research tool. They also have a built-in education platform you can use to upskill your trading knowledge.

Mobile Trading

Currently, you can you use the MetaTrader 4 platform on Android and iOS devices. This has been perfected over the years and provides a solid offering which replicates a lot of the positive aspects of the desktop version. It works well and is your go to option if you have no need to do anything too fancy through your mobile device.

The proprietary trading platform Status does not yet have a mobile version, but it is something that they are currently working towards. They are trying to ensure that this mobile experience will be seamless, hence why they did not want to rush out this platform too early.

Pricing

No matter what type of account you are suing at EverFX, you are going to be dealing with the same types of variable spreads. These are normally fairly tight but you do need to deal with commission fees.

These will change, ranging anywhere from $4 to $8 per round lot. Therefore, for the standard account option, you will be looking at trading costs just below the 1.00 pip mark for the EUR/USD trading pair. This is a pretty competitive price structure, as a lot of their competitors will lie in the 1.0 to 1.5 range.

Deposits & Withdrawals

With EverFX, you have access to a number of different options for making your deposits and withdrawals. You can use the popular credit and debit cards such as MasterCard and Visa. You can also send funds through a bank wire transfer and some of the more common e-wallet choices such as Webmoney, Neteller and Skrill.

Currently, they do not have a minimum withdrawal that you have to make to get your funds. There have been some issues reported by customers with regards to making withdrawals. There is also a minimum required deposit required of $250 when you open a standard account.

Customer Support

With EverFX, you can only get in touch with their customer support team on a 24/5 basis. This is in comparison with the 24/7 customer support some of the leading brokers have started offering their clients.

Despite not opening on the weekends, the customer support team is well trained and is a very useful service if you are experiencing an issue or problem. They are one of the industry exceptions in this regard, as a lot of the support options out there are pretty poor.

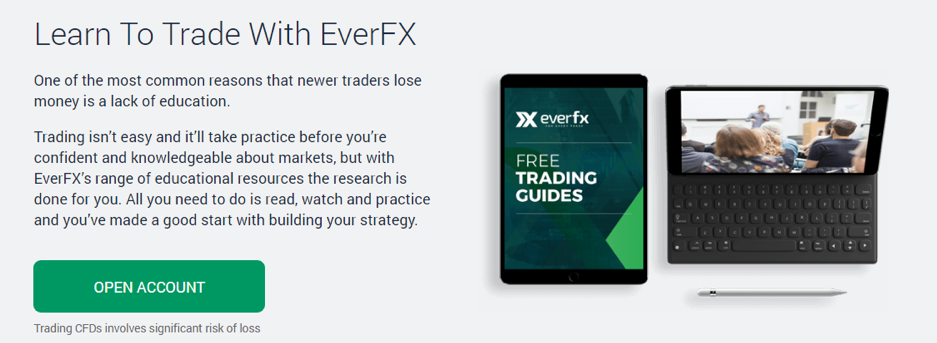

Research & Education

EverFX has a very good educational offering no matter what sort of experienced trader you may be. They have regular webinars and seminars that you can choose to improve your education in various aspects of your trading. They also have a series of videos, eBooks and guides for beginner traders when they are getting started in the space.

They are lacking when it comes to research. They do not really update their news section so a trader with EverFX is going to have to do their research elsewhere.

Noteworthy Points

Generally, the jury is still out on EverFX as there have been mixed reports so far from their customers. While some are happy with the service, there have been some complaints with the withdrawal process, which is not something most traders will want to risk.

Their platforms and website are very easy to use and they do have a standout education platform particularly for beginner traders. They did win two awards in 2018, being presented with the Fastest Growing CFD Broker award in Europe as well as being the Best New Multi-Asset Broker in Europe.

Conclusion

Overall, there are some distinct pros and cons when it comes to EverFX. They are somewhat conservative with their offering of investment products, but they do have plenty of options for you to choose from.

Both of their desktop trading platforms are top quality and they have one of the best customer support teams around, even if they only operate on a 24/5 basis. There have been a few issues with withdrawing funds from EverFX accounts and they have a pretty non-existent research offering. Their prices are competitive however and they are rapidly growing their business year on year.

Overall, it may be a case of wait and see with EverFX. They only started offering brokerage services in 2017, so they may still have a lot of teething issues that can be ironed out before you open an account with them.

Comparison

Broker Comparison Maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

User Reviews

2.8

Based on 1 ratings

Login to leave a review

Log in