FXTM

Pros

- Many different account types

- Top quality regulators

- Wide range of instruments

Cons

- Low level of max order size

- Some excessive market segmentation

- ECN accounts restrict margins and leverage cap

Min Deposit

$5Max Leverage

1:300Mini Account

Platforms

Withdrawal Options

- Credit Cards

- Bank Transfer

- Skrill, Neteller

Review

Introduction

FXTM was launched back in 2011 in Cyprus and they had the goal of providing top quality education, great trading conditions and modern trading tools.

They are licensed under numerous key regulators, including the likes of the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the United Kingdom and the Financial Services Board (FSB) in South Africa.

They have won numerous awards over the years, including being awarded the broker with the best trading conditions in 2018 and the most innovative broker in 2018.

There is over a dozen different languages catered for and their website looks very sleek and is easy to navigate.

- Many awards won over the years

- Regulated in the likes of Europe and South Africa

- Easy to use site

Trading Conditions

One of the areas that FXTM has a lot of pride in is their diverse offering of account types. There are two main differentiating sections as part of their account type, being standard accounts and ECN accounts.

There are three main standard accounts. The Cents account type has a £5 minimum deposit, no commission is charged, there are 27 types of instruments to be traded and it has instant execution.

The Standard account has a £100 minimum deposit, is instant execution no commission is charged, and there are 76 types of instruments able to be traded.

The Shares account type does not have any leverage (the other two accounts do have varying levels of leverage), there is a £100 minimum deposit, instant execution, no commission is charged and there are more than 180 types of instruments that can be traded.

There are five different ECN accounts. The main ECN account has a £500 minimum deposit, market execution, £2 per lot commission and 62 types of instruments. The ECN Zero Account has no commission, market execution and 66 different tradeable instruments.

The FXTM ECN MT5 account has £2 per lot commissions and 36 types of instruments to trade. The Strategy account has a £100 minimum deposit, is market executing, no commission is charged and there are 57 types of instruments available.

Finally, the FXTM Pro account has max leverage of 1:200, there is a £25,000 minimum deposit, market execution, no commission and 4 different instruments to trade.

- 3 different standard accounts

- 5 different ECN accounts

Products

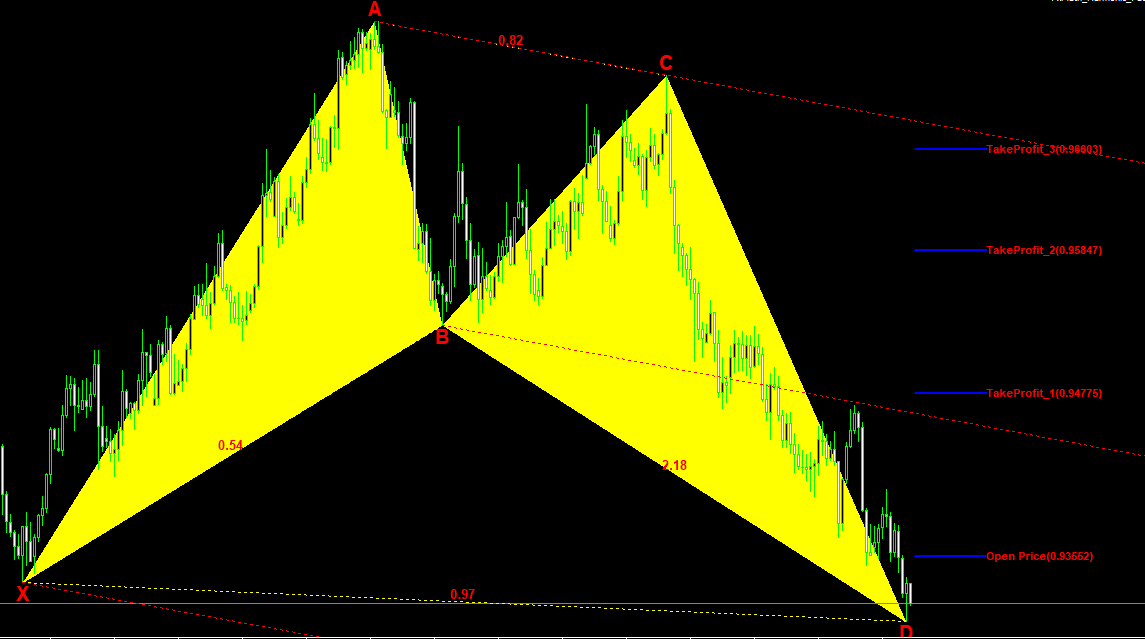

While the offering of investment type spends on what type of account you go for, in total there are 59 different currency pairs to be traded, over 190 CFDs that can be traded, no ETFs and recently they added a CFD offering for cryptocurrency.

- 59 currency pairs offered

- 190+ CFDs offered

Regulation

FXTM are regulated by a number of different authorities. They are licensed by the CySEC and their Cyprus Investment Firm license number is #185/12. They are also licensed by the FCA in the United Kingdom, their license number being 777911.

These are two of the most respected authorities in the world, so you can be sure that your money is safe with FXTM. They also have license in South Africa with the Financial Sector Conduct Authority (FSP number 46614) and in Belize International Financial Services Commission – license number IFSC/60/345/TS.

- Regulated by respected authorities in Europe, the United Kingdom, Belize and South Africa

Platforms

All of the trading platforms that are offered by FXTM are tried and tested over the years, being proven to operate at a high level at all times. The offering is the industry standard MetaTrader 4 and MetaTrader 5 platforms which most experienced traders will have some experience using.

The MetaTrader 4 platform is still the most popular trading platform in the forex industry and it is very user friendly, has a quality charting offering, supports many languages and is secure.

The MetaTrader 5 platform is an upgrade to MT4 and it is easier to navigate and has a wider range of technical indicators that you can use.

There are numerous analysis offerings by the folks at FXTM that will help you with your trading.

- No proprietary software

- MetaTrader 4 and MetaTrader 5 trading platforms

Mobile Trading

Both MT4 and MT5 have quality mobile apps that can be used on Android and iPhone devices. These apps can be downloaded from the respective app stores and they work just as well on mobile as they do on a desktop.

There is also a FXTM app which provides a variety of different tools and functions that helps a trader to make key decisions when reacting to different pieces of news.

- MT4 and MT5 app for trading

- FXTM app for analysis

Pricing

As there are so many different types of accounts, they each have their own prices and fees structures. For the three standard accounts which have instant execution, the spreads are pretty good when compared to industry standards.

They also have a competitive fee structure for their ECN account options. For the accounts with commission, they are only £2 per lot, which is very good. The pro account has the lowest spreads, but this is not applicable to most traders. Therefore, the other account with the lowest spreads is the main ECN account. The average spread for EUR/USD o the standard account is 0.80 and the all-in cost is 1.00.

- Very competitive spreads on both account types

Deposits & Withdrawals

With almost 500,000 worldwide traders using FXTM, the need to have a wide array of banking options for them. They do not disanointing this regard, with over 30 different types of payment methods available.

There are local options, debit and credit card choices, e-wallet offerings and bank wire transfer. Popular e-wallets offered are Skrill and Neteller. Deposit processing times are almost instant when it comes to the e-wallets and it can take 3-5 working days to process when you deposit via a bank transfer.

When withdrawing the processing time is generally 24 hours for cards and e-wallets, while it will take about 3-5 working days with a bank transfer

- Over 30 different payment options

- Standard processing times

Customer Support

There are numerous ways in which you can get in touch with a member of the FXTM customer support team. You can choose from live chat, email, telephone and social media.

They offer local support in many of the key countries in which their traders are located within. They cater for 18 languages and it is easy to get in touch with a team member that can help to quickly resolve your issues.

You also have the option of looking through their comprehensive FAQ section which could very well have the answer to your question.

- Many contact options

- Available 24/5

Research & Education

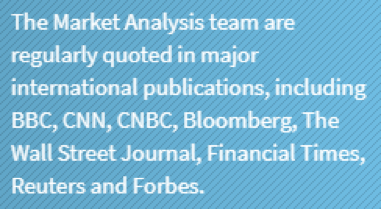

There is a lot of comprehensive research conducted by FXTM on a daily basis for both technical and fundamental analysis. They have a team of experts in place who provide daily videos and blog post, as well as in-depth reports every quarter.

In terms of their education resources, there are regular webinars and many tutorials available for all levels of traders to benefit from. It covers a lot of the bases you need when it comes to trading. There are also regular seminars and workshops conducted across the world.

- Daily research articles and videos

- Quality education section

Noteworthy Points

FXTM is well respected in the industry and this is reflected by the many awards they win on an annual basis. They are overseen by well-respected regulators and their platforms are very easy to use for beginners, as well as providing everything a more experienced trader needs.

There are over 18 languages catered for and they sponsor many events such as the Sahara Force India Formula 1 team and the Indy500 project.

Conclusion

Overall, FXTM has a quality offering in most aspects. They have many different account types so you can find what suits your needs the best, they have competitive spread and a decent offering of instruments.

They have an abundance of banking options and regular processing times. There is a decent level of customer support and the trading platforms are industry standard.

If you are looking for an all-round solid broker, FXTM definitely makes the list.

Comparison

Broker Comparison Maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

User Reviews

2.9

Based on 1 ratings

Login to leave a review

Log in