iTrader

Pros

- Nice education section

- Reliable customer support

- Diverse asset classes

Cons

- Average website design

- High minimum deposit requirement

Min Deposit

$250Max Leverage

1:500Mini Account

Bonus

N/APlatforms

- MT4

Withdrawal Options

- Qiwi

- Cards

- Skrill

- Vload

- WebMoney

- Yandex

- Neteller

Review

Introduction

Established in 2012, iTrader is an online brokerage company that specializes in offering financial services in the FX and CFD arena. The company is owned by Bayline Trading Ltd, a Belize registered company. The company’s license allows it to carry on operations across Europe and several other countries outside Europe.

iTrader has a simple to use website, handy navigation tools and is available in four different languages; English, Russian, Spanish, and Portuguese.

Trading Conditions

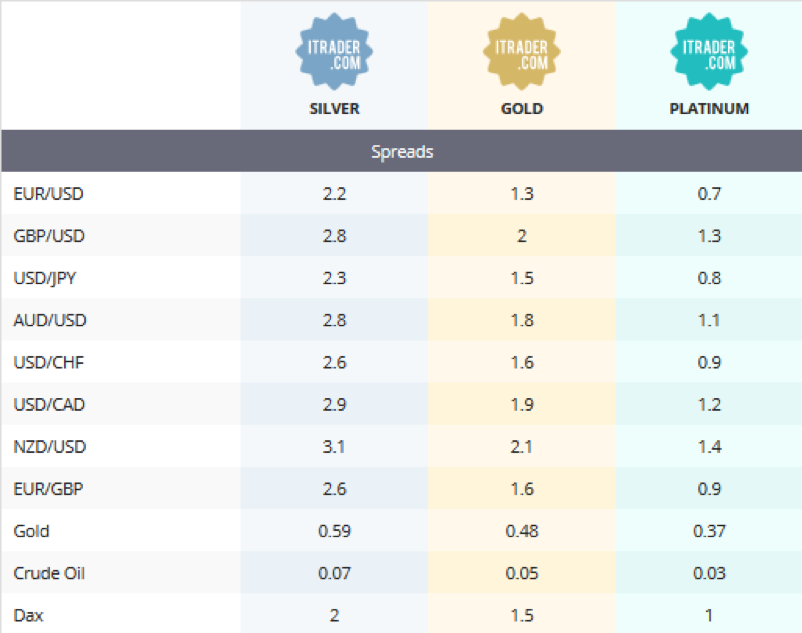

iTrader offers its customers excellent trading conditions. Unlike its UK counterparts, the broker offers leverage of 1:500 for some assets though without any bonuses. The trading platform is the MT4 which is known for very fast load speeds for charts and low latency on a stable network. iTrader offers traders the following account types; silver, gold, and platinum. The silver is the basic account and would be considered a beginner account while the platinum account would be considered for elite traders. The silver account has a minimum deposit requirement of $250, which is similar to the Platinum account. Apart from the deposit requirement, the spreads are also different. The platinum has a spread of 0.7 for EUR/USD pair while the silver account is 2.2 for the same pair.

Products

iTrader offers over 150 trading instruments clustered under the following categories; forex, indices, commodities, and stocks. There are 49 FX pairs including major pairs, minor pairs, and exotic pairs, 17 indices, 17 commodities, and 81 shares for UK and US companies. The company doesn’t offer cryptocurrency trading or options.

Regulation

iTrader is regulated by the Belize International Financial Services Commission under license number 60/332/TS/17. The payments for iTrader are handled by Bayline Global World Limited, which is a UK registered company. The details of licensing of Bayline Global World Limited aren’t highlighted on iTrader’s website.

Platforms

iTraders uses the MetaTrader 4 platform as its sole trading platform. The MT4 is available as a desktop version and the web version. The MT4 is a powerful trading platform available in 37 different languages. The trading platform has dozens of technical indicator tools, multiple chart layouts, chart customization tools, news feed, and reports tools. The MT4 is a common platform among many online brokers and is known to sit well with newbie traders and experienced traders.

Mobile Trading

iTrader allows you to manage your account and trades conveniently from your smartphone, iPad, or tablet using their mobile-friendly MT4 platforms. The broker offers free to download Android and iOS MT4 apps which you can find in the Play Store or iTunes Apple Store respectively. The mobile trading platform has the same features as the PC version and it supports both Forex and CFDs trading.

You can set basic alerts, chart trend lines, and add up to 30 indicators using the mobile app. This integration makes it easy for traders to enjoy increased trading times and better access to financial markets, as they can monitor the trends and grab trade opportunities on the go.

Pricing

iTrader operates a non-dealing desk model; therefore, there isn’t room for zero spreads or commissions. All the trading instruments are tied to a fixed spread. The lowest spreads as of December 2018 was for the EUR/USD which was as low as 0.7 while for the AUD/USD pair was 1.1. Compared to some of its rivals, it is fair to say that iTrader has competitive prices. The good thing about the fixed spreads is that during volatile news the spreads are static and don’t widen.

Deposits & Withdrawals

iTrader supports a variety of popular payment methods including major credit cards like Visa, Maestro, American Express and MasterCard and bank wire transfers for both deposits and withdrawals. You can also fund your iTrader account via Skrill, Neteller, WebMoney, Yandex, and Qiwi, and the accepted currencies for all banking options are USD, EUR, and GBP. The minimum deposit amount for both initial deposits and consecutive top-ups is $/€/£250 and there’s also a minimum withdrawal limit of $100 per request.

All deposits made to the trading platform are processed instantly but sometimes it may take up to 24 hours for the funds to be reflected in your iTrader account. For withdrawals, the broker may take up to 5 business days to process a request and their representatives contact you by email or phone in the course of this time to validate the application and seek your approval before beginning the process. After the confirmation, you have to wait for additional 5 to 7 business days for the funds to reflect in your bank account. However, you can expedite the withdrawal processing time by verifying your account in accordance with the company’s guidelines as soon as possible.

The broker covers all the processing fees for deposits and withdrawals hence all transactions made on the platform are free of charge.

Customer Support

iTrader has a professional customer support team who are available Monday through Friday from 0100 hrs to 1400 hrs GMT. Their representatives communicate in a variety of languages including English, Russia, Spanish, and Portuguese and you can reach them via live chat, email, or telephone. You can use the following contact details to reach out to iTrader’s client support representatives.

Email:

Telephone

Great Britain: +44 208 068 4898

Russia: +74 953 690 197

Bahrain: +97 365 009 247

Brazil: +55 213 500 0210

Colombia: +57 289 12 852

In case the customer support agents are offline, you can fill the online contact form provided on their contact page and they will get back to you when they are back online. Their website also features a FAQs page, that covers a wide range of topics such as online trading instruments, currency pairs, trading limits, accounts types, bonuses, spreads, and banking options. Finally, all clients with Platinum and Gold memberships have a dedicated account manager to assist them with any issues regarding their accounts.

Research & Education

iTrader provides traders with a premium education site that is free for access to all website visitors. The broker has distinguished itself with the quality of educational materials on its website. There are eBooks, articles, V.O.D, tutorials, glossary, and courses. The education materials are in-depth; for instance, there are 10 trading strategies.

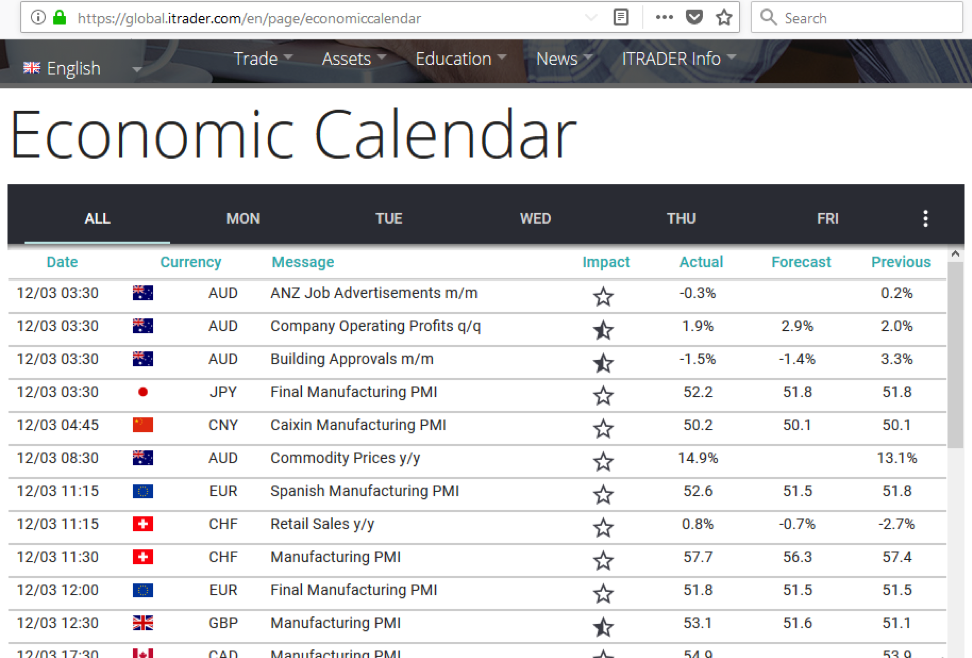

There is an economic calendar, a market commentary section, and a pip calculator.

Noteworthy Points

iTrader offers add-on services but they mostly apply to the platinum account. For instance, traders who use the platinum account enjoy free VPS, free news alert, and a dedicated account manager. iTrader has in the past been crowned by FXEMPIRE as the best educational broker 2016, therefore you can count on it as a reliable online broker.

The broker regulation in Belize rather than in the UK places this broker at a disadvantage, considering that traders often hunt for forex brokers who are licensed by stricter regulators, such as CySEC or FCA. As a result, the firm has done very little in terms of advertisements and sponsorships since professional traders are always in pursuit for brokers regulated by top tier regulators. In as much as the broker seems to be laid back, it hasn’t received any penalty from its current regulator and there aren’t any complaints online from traders who use its service.

Conclusion

iTrader is a broker that would be better described as average. Their website platform is average, their range of trading instruments are ordinary, the language options are only four, and several of its services seem to be average except for its education section. To avoid all this averageness, you will be required to use their Platinum account type to enjoy some VIP status, even though it still might look basic to some of its rivals. This broker suits new traders who are in the pursuit of trying their hand in forex trading. They will benefit more from the educational material and the competitive fixed spreads.

Comparison

Broker Comparison Maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

User Reviews

5

Based on 1 ratings

Login to leave a review

Log in