XTB

Pros

- Excellent trading platforms.

- Highly reputable broker

- Competitive spreads

Cons

- No 24/7 support

- Does not offer social trading

- Does not provide VPS

Min Deposit

$250Max Leverage

1:200Mini Account

Bonus

VariesPlatforms

- xStation 5

- MT4

Withdrawal Options

- PayPal

- Wire transfer

- Credit cards

- Neteller

Review

Introduction

XTB is a renowned CFD brokerage company founded in 2002. Over the years, this broker has gained the reputation among the most reliable trading platforms.

The forex broker has over ten offices across the world and offers services in over ten languages to include English, Spanish, Polish, Czech, French, Hungarian, Italian, Russian, and Turkish among others.

XTB is regulated by FCA and FSCS and is also listed in the Warsaw Stock Exchange. This makes it a reputable broker, given the level of transparency required for publicly traded companies.

The broker offers numerous tradable assets including shares, commodities, market indices, and cryptocurrencies. The XTB platforms are also reasonably easy to use.

Trading Conditions

XTB provides two types of trading accounts namely the Standard and the Pro. Their minimum deposit is a bit high standing at $250. Their leverage is within the industry average at 1:200.

The forex broker offers some amazing spreads and includes both fixed and variable spreads. One thing we didn’t like about XTB is their lack of a mini account. The trading service provider does not offer Islamic accounts either.

The fact that XTB offers a demo account makes them a trading platform worth giving a try for traders who can afford their minimum deposit. It is important to note that the high deposit requirement comes with extra trading privileges.

Products

As mentioned earlier, XTB offers a wide variety of tradable assets. Some of the products provided by this broker include commodities, stocks, currencies, indices, CFDs, bonds, and ETFs.

The fact that there are numerous products on offer gives traders an opportunity to explore trading various assets.

Regulation

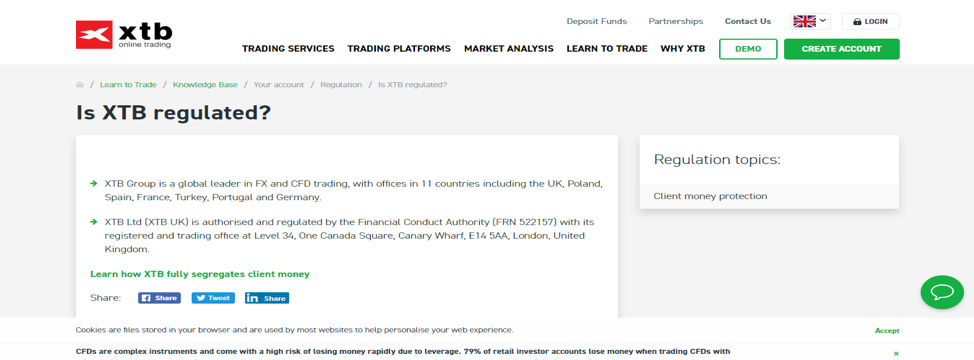

Multiple regulatory authorities regulate this London-based online forex broker. In the United Kingdom, XTB's activities are monitored by the FCA under license number FRN 522157.

Other regulators include Financial Service Compensation Scheme (FSCS), Capital Market Board of Turkey (CMB) and Federal Financial Supervisory Authority (BaFin).

One thing you should know about financial oversight authorities is that they are always on the traders’ side. Regulatory bodies such as FSCS guarantees traders that their deposit is protected in case the broker goes bankrupt.

Platforms

Most traders love trading with brokers that offer easy to use trading platforms. XTB is among the top forex brokers regarding trading platforms reliability. The broker’s trading platforms include xStation 5 and Metatrader4.

Metatrader4 is one of the most preferred trading platforms in the industry because of its multiple trading tools. Additionally, Metatrader4 is in a position to offer automated trading thanks to its AI-based Expert Advisors.

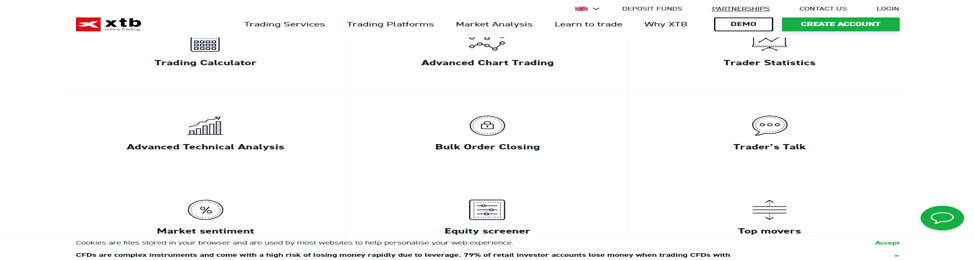

The xStation trading platform is efficient and offers fast execution time. Additionally, xStation 5 comes with many features including an equity screener, and a trading calculator.

Mobile Trading

On mobile trading, XTB hasn’t been left behind. Their various trading platforms are mobile-friendly. For instance, XTB’s Metatrader4 platform is available in both iOS and Android apps.

With all the fantastic features and tools that come with the Metatrader4 platform, XTB customers have a chance to trade from the convenience of their mobile gadgets. Their web-based xStation five platform is also accessible through tablets and smartphones.

Pricing

As mentioned earlier, XTB offers competitive spreads starting from as tight as 0 spreads for Pro accounts. Their spreads are both fixed and floating with the former being for basic accounts and the latter for standard and pro accounts.

The minimum average spread for the EUR/USD pair in the basic account is two pips while that of the standard and pro accounts is 0.35 pips and 0.28 pips respectively. Compared to other trading platforms, XTB's average EUR/USD spreads for the basic account are relatively higher.

With this broker, traders are only charged when they trade. This is an ECN/STP broker meaning that they charge a commission on trades.

Deposits & Withdrawals

The forex broker’s deposits & withdrawal feature is fast and relatively cost-friendly. However, although XTB supports eWallet deposits, we were not impressed by their high charges.

With this broker, the average wait time for withdrawals in the British Pound denomination is one day. Other currencies take between 2 to 3 days.

XTB supports credit card, Neteller, Skrill, bank transfer, PayU, and PayPal. If you don't want to incur withdrawal charges, we advise you always to withdraw more than $100.

Customer Support

The broker has a reliable and super fast customer service. Both phone and live chat support services are offered. One thing we didn’t like about the forex broker’s customer support is their e-mail support service.

Messages sent through email can take up to two weeks to get a reply. If 24/7 customer service is something you look for in an online brokerage company, then XTB is not for you. They offer 24/5 support.

We were, however, impressed by their multilingual customer service. In addition to English, phone customer service is also offered in Romanian and Hungarian.

Answers provided by XTB's customer service team are okay but are not always a hundred percent accurate. We, therefore, advise that you do further research before making a decision.

Research & Education

You’ll love XTB’s research & education resource center because of how well it is organized. Not only does their good organization make the section easy to read and understand, but it allows traders to find relevant content fast.

Some worth mentioning education materials offered by the CFD broker include webinars, tutorials, educational videos, and FAQs.

Their educational videos are organized correctly based on trader level and subject matter. Beginner traders have an option to take basic trading lessons right from their website without registration requirements.

Noteworthy Points

Judging by the multiple regulatory bodies that oversee the activities of XTB, we are convinced that the forex brokerage company is safe.

We believe that newbie traders will have a wonderful time using XTB because of their straightforwardness and their ease of use. In addition to offering low spreads, XTB gives customers a chance to trade with a variety of instruments.

The only downside is that the minimum deposit required is a bit high and may therefore many beginner traders may be more attracted to others.

Conclusion

From the look of things, we can safely say that XTB is a safe brokerage service provider. Various reputable regulatory bodies monitor XTB’s activities in Europe and around the world.

The broker’s minimum deposit is $250, and demo accounts are offered. Their leverage ratio is 1:200. XTB provides numerous products such as stocks, indices, and shares.

Their xStation 5 and Metatrader4 trading platforms are something to talk about. Besides being user-friendly, these platforms come with a lot of unique features and support customization.

While the broker seems to have a lot of pros, there are many factors we didn't like about them. For instance, their customer service is a mess. Not only is it unreliable, but it is also not highly-knowledgeable. Generally, XTB is worth trying.

Comparison

Broker Comparison Maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

User Reviews

4.4

Based on 1 ratings

Login to leave a review

Log in