CMC Markets

Pros

- Established in 1989 so an extensive history

- Regulated by the FCA

- Extensive trading instruments

Cons

- No regulation from CySEC

- No EAs allowed

- High phone brokerage fee

Min Deposit

$0Max Leverage

1:500Mini Account

Platforms

Withdrawal Options

- Bank Transfer

- Credit Card

- Debit Card

Review

Introduction

CMC Markets is among the oldest forex brokers, having been established in 1989 in the United Kingdom. The headquarters of this platform is in London, which makes it an FCA-regulated broker. The FCA also regulates users in Ireland and Europe. Additional regulation comes from ASIC in Australia, MAS in Singapore, FMA in New Zealand, and IIROC in Canada.

Over the years, CMC Markets has accumulated numerous accolades, with just 50 awards in the past 2 years. Just some of its honors in 2017 include Best Forex Trading Support from UK Forex Awards, Best Online Trading Platform and Financial Services Provider of the Year from Shares Awards, Best Spread Betting and CFD Education Tools from ADVFN International Finance Awards, and Best Platform Features from Investment Trends 2017 Australia CFD Report.

The default page for CMC Markets is an international site in English, although it is also available in Chinese. There are 14 country-specific pages with corresponding language options, including in English, Chinese, Italian, German, Norwegian, Polish, Spanish, and Swedish.

To make the CMC Markets platform easier to use, there is a 20-page quick guide that is easy to find in the broker’s website. There is also an FAQ section for the platform divided into the web platform and mobile applications. With these tools, reliable customer support, and the intuitive nature of the platform, most traders will find it easy to use.

Trading Conditions

In the U.K., leverage goes from 30:1 for forex, 20:1 for indices, 2:1 for cryptocurrencies, 20:1 for commodities, and 5:1 for shares. In other regions, these can be as high as 500:1, 500:1, 4:1, 200:1, and 20:1, respectively. Spreads go from 0.7 for forex, 0.3 for indices, 60 for Bitcoin, 6 for Ethereum, and 0.3 for commodities.

The only variations in account types offered by CMC Markets are based on the geographic location of the client and the choice of a demo or live account. No bonuses are currently listed on the CMC Market website.

Products

In terms of the range of markets offered, CMC Markets stands out from the competition. There are over 330 forex pairs, more than 90 indices, more than 9,000 shares and ETFs, over 110 commodities, and over 50 treasuries for a total of over 10,000 instruments. As such, very few traders will find themselves in search of more markets than those offered by CMC Markets.

Regulation

As previously mentioned, CMC Markets is based out of London and regulated by the FCA, but its license number is not listed on its website. The FCA regulation for CMC Markets applies to all of Europe. CMC Markets is regulated by ASIC in Australia, by MAS in Singapore, by IIROC in Canada, and by FMA in New Zealand.

Platforms

The platform used by CMC Markets is a proprietary one, which is available either as a web trader or a mobile trader with both standard and advanced options. The platform is set up in a very similar manner to other popular platforms, allowing for intuitive use. The option of Standard and Advanced views helps the platform appeal to traders with a range of experience levels.

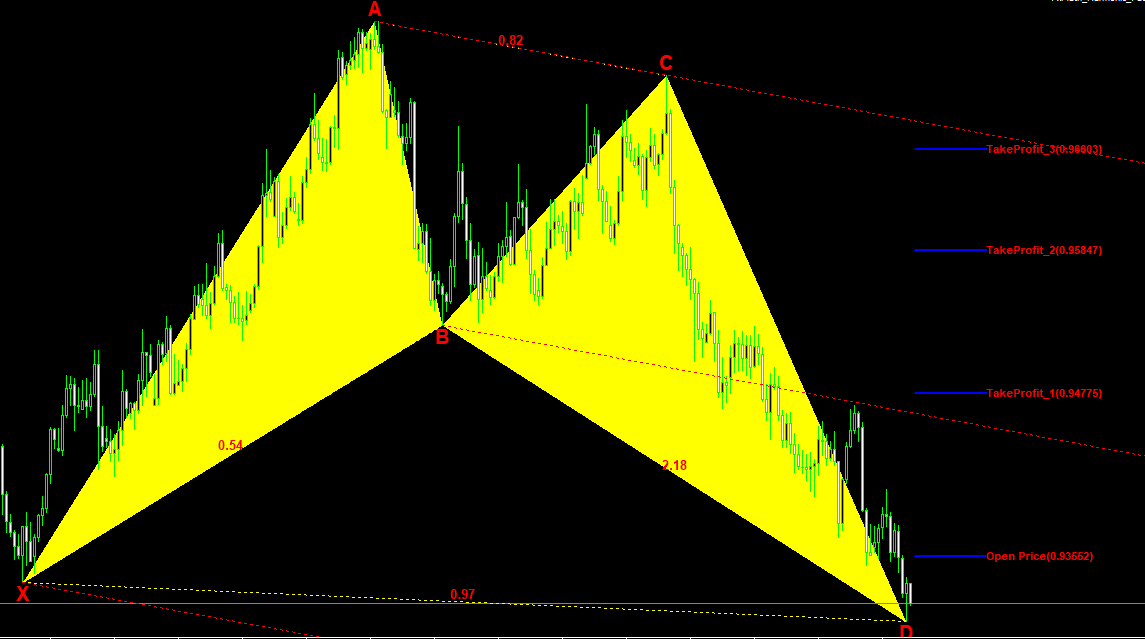

The proprietary CMC Markets platform includes an advanced charting option apart from the standard one, helping it to appeal to professional and experienced traders as well as beginners. CMC Markets’ charts are recognized as industry leaders with 12 chart types, drawing tools, and more than 115 technical indicators. The platform even has over 70 chart patterns. There is mobile charting, a chart forum, module linking, price projection, and technical analysis, all fully integrated into the platform.

The fully integrated technical analysis suite allows for easier analysis of charts, and there are more than 35 drawing tools to utilize. These tools allow you to accomplish a lot, like draw resistance and support levels, highlight patterns and key price movements, and make notes right on the charts. There are over 30 overlays plus 50 studies for technical indicators that help you identify trend reversals and significant price levels. The charts are also highly customizable, let you save default layouts, and allow trading right from the charts. Traders also have access to daily news and analyses to help guide their decisions.

The Chart Forum is particularly useful as it connects to the trading community, giving you the ability to share, discuss, or copy chart analysis. You can also use it to comment on posts from other traders and save analyses. This feature is available on both the mobile and web versions of the platform. CMC Markets does not list which languages are available on their platform.

Mobile Trading

The CMC Markets website is mobile friendly for convenience. The broker also offers a mobile application of its own, available for either Android or Apple. This mobile app has full functionality, including the ability to chart and more, although it is easier to use advanced tools on the website.

Pricing

There are no ECN or “Zero” accounts with zero spreads available via CMC Markets. Instead, the broker offers competitive pricing via its spreads. Spreads can be as low as 0.7 points. Commissions for trading shares start at just 0.1 percent. Traders can check anytime the current spreads on the page, titled “CFD Spreads and Commissions.”

Deposits & Withdrawals

Clients can fund their CMC Markets account via debit or credit cards or a bank transfer. The broker does not accept cash deposits or checks. Cards must have 3D secure to be eligible. There is no minimum deposit required to activate an account although you cannot trade without sufficient funds. Both deposits and withdrawals are simple to make via the “Payments” section of your account. Clients can withdraw funds to the same card used to make a deposit, provided they have used the card on their account within the last 12 months, and it is a Visa card. Otherwise, withdrawals are done via bank transfers, and requests are processed the same day.

Customer Support

In addition to the platform user guide and platform-specific FAQ, there are many other categories in the FAQ, including products, trading issues, price adjustments, and other user guides. You can browse the FAQ categories or use the search function on the support page. There is also an extensive glossary on the same page. CMC Markets has excellent phone support, which is open 24 hours a day, so you can access the team whenever the market is open. Impressively, 98 percent of calls to CMC Markets support are answered within 20 seconds. Alternatively, you can email customer support.

Research & Education

CMC Markets provides extensive education as well as research tools, all of which are automatically available to anyone with an account. The “Learn” page features tools for all skill levels, including a glossary, trading guides, webinars, and events. You can browse based on these categories or look at specific materials for forex, CFDs, fundamental analysis, technical analysis, or platform guides. The videos and articles are particularly helpful to beginners, although advanced traders will also pick up new skills from these resources.

In terms of research, all account holders automatically get access to the “News & Analysis” section, which includes an economy calendar, webinars, market analysis by experts, charts, market insights, and weekly outlooks.

Noteworthy Points

Overall, CMC Markets has an excellent reputation thanks to its long list of awards and reliable history in the forex world. The platform is easy to use and available in enough languages to appeal to a diverse audience of traders. CMC Markets has not faced any recent investigations or penalties, adding to the broker’s strong reputation.

Conclusion

CMC Markets is a highly regarded forex broker that offers an impressive array of instruments, with more than 10,000 to choose from. This vast selection makes the CMC Markets platform extremely competitive and stand out from other brokers. The broker also has decades of experience to inspire confidence. Its regulation by the FCA is also a strong point in favor, as are the dozens of awards that the broker earned within the last two years, including several for its platform.

Although CMC Markets has its own platform that is not used by other brokers, it is still intuitive to use and will appeal to all traders. Beginners will likely stick to the standard view while experienced traders will use the advanced view and the long list of included tools and advanced charting features that come standard, such as the 115 indicators. The availability of mobile applications also adds to the platform’s appeal. Because of the range of tools available on the platform and long list of instruments, CMC Markets can appeal to traders regardless of their experience level.

Comparison

Broker Comparison Maecenas porta rhoncus dui ut congue. Donec luctus non sem eu euismod. Ut rhoncus mauris non bibendum congue. Donec maximus ipsum a lectus sollicitudin.

User Reviews

2.1

Based on 3 ratings

Login to leave a review

Log in